Paper in reading: Amman, Cochardt Cohen and Heller (2024), Hidden Alpha, Working Paper, https://www.hbs.edu/faculty/Pages/item.aspx?num=63490

Fund managers’ social network might have impact on fund performance due to information flow or information advantage. A fund manager’s social network can be identified via several ways including shared education network and residence in the same neighborhood.

From shared education network perspective, Cohen, Frazzini and Malloy (2008) identified information flow between fund managers and board members via shared education network, and fund managers tend to place larger bets on firms they are connected via such network. and the effect is larger is the educational connection is much stronger. Lin, Wang and Wei (2021) documented the social network effect from the alumni relationship of fund managers in China. They found central network positions of hedge fund managers in China invest more actively and have better risk-adjusted returns. This might due to they have information advantages.

On a different way, Pool, Stoffman and Yonker (2014) provided evidence on word-of-mouth influence among managers living in the same community which could share valuable information. Fund managers who are neighbours have significantly more common in trades than those not. and even a long-short strategy based on the trade decisions among neibghourhood managers is likely to deliver an average 5.6% above benchmark returns.

The working paper of Amman, Cochardt, Cohen and Heller (2024) is trying to understanding the performance impact of non-public personal relationship between fund managers and company officers. They utilize data on Facebook to construct their dataset of fund manager and firm officer connection. They document significant abnormal returns in domestic and actively managed US equity funds performance from the hidden connections between fund managers and company officers.

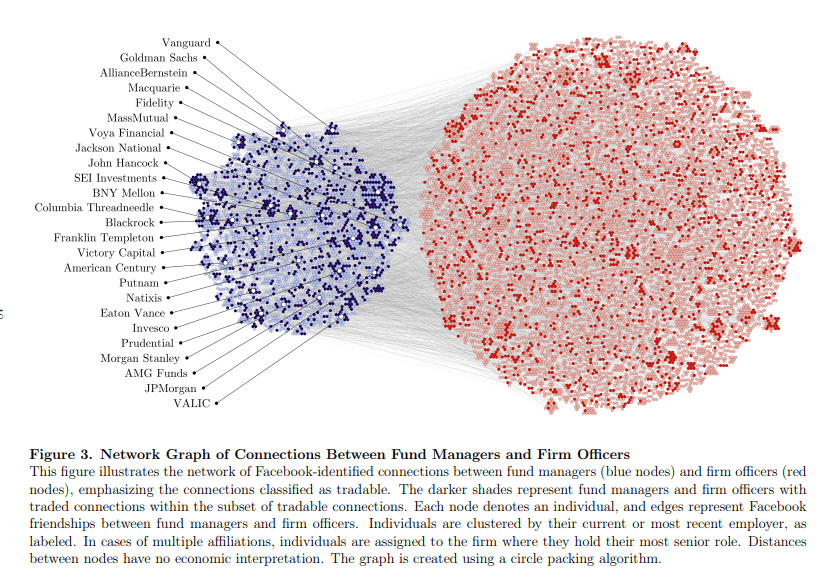

They construct a unique dataset with more than 4,000 fund manager Facebook profiles, over 100,000 firm director profiles, and about 35 million friends connected to these profiles. They collect profile data from Facebook, and they try to match Facebook profiles with fund managers and company officers. So they apply customized string search to get results, and infer the information from Facebook id, commonalities among one’s friends, and using face recognition algorithm if photos are available. In all, they matched 4,198 fund managers and 101,866 company officers.

To identify friendship ties, they collect friend list and utilize the mutual-friend feature to check and analyse their Facebook interactions. they collect about 2.1 mil Facebook reactions data of fund managers and 59.4 mil of firm officers. These reactions include likes, comments and tags. Based on the friendship identified, they classify these connections into public, one party hides (hide by a fund manager or by a corporate officer) and both parties hide.

They have many interesting findings in their study.

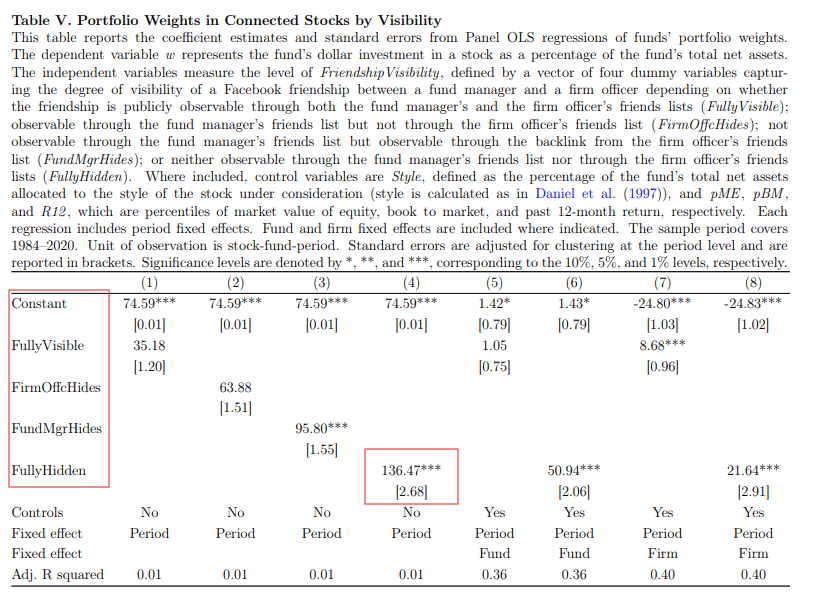

From a portfolio weight perspective, fund managers on average invests more in the firms which their friends are officers. Especially when both fund managers and firm officers fully hide their friend list, these fund managers tend to invest 136.5 bps in their friend’s company.

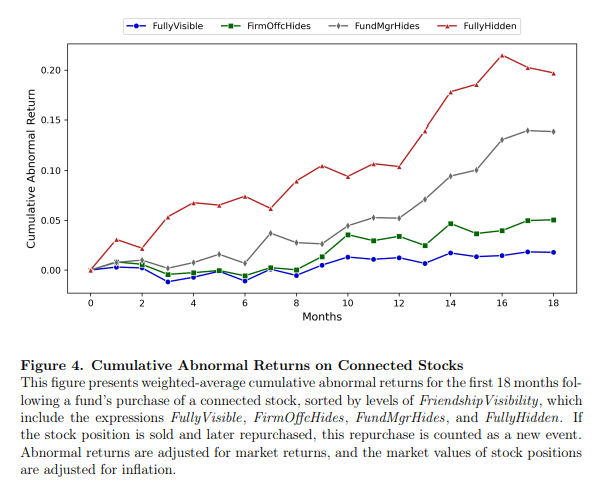

In regards to performance of allocating additional capital to firms whose officers are fund managers’ hided Facebook friends, they replicated portfolios based on the funds’ holdings. Using Carhart Four Factors model to test, the connected stocks when fund managers hided friend lists have a monthly alpha of 56 bps. When both fund manager and firm officer hided friend lists, the connected stocks achieved a monthly alpha of 135 bps and the long-short strategy based on such has an average of 136 bps alpha. The results are consistent using DGTW-adjusted returns or raw returns. This results is also significant when they evaluate the results on trading basis.

Based on their findings, it looks like there are some valuation information flows when both parties hide their Facebook friend list. This action gives rise to some premium while not seen in the scenario when fund managers and firm officers disclose their friend lists on Facebook.

Reference List:

Amman, Cochardt Cohen and Heller (2024), Hidden Alpha, Working Paper, https://www.hbs.edu/faculty/Pages/item.aspx?num=63490

Cohen, Lauran, Andrea Frazzini and Christopher Malloy (2008), The small word of investing: board connections and mutual fund returns, Journal of Political Economy, (https://doi.org/10.1086/592415)

Lin, Junqin, Fan Wang, and Lijian Wei (2021), Alumni social networks and hedge fund performance: Evidence from China, International Review of Financial Analysis, Volume 78 (https://doi.org/10.1016/j.irfa.2021.101931)

Pool, Veronika Kerpely, Noah Stoffman and Scott E Yonker (2015), The people in your neighborhood: social interaction and mutual fund portfolios, Journal of Finance, Volume 70 (https://doi.org/10.1111/jofi.12208)