There are two rules that PBOC use to find the appropriate interest rate level, according to Governor Yi Gang of PBOC talked at his PIIE speech in April 2023. First, Taylor’s rule is important for PBOC when focusing on short term countercyclical management. Second, for long term, the focus is shifted to optimal trajectory and the relationship between real interest rate and potential economic growth rate. In equilibrium, the real interest rate should be roughly equal to the economic growth rate. This is what he called a ‘Golden Rule’.

Following the above two rules, PBOC’s best approach is setting the real interest rate more or less equal to the potential growth rate. The rationale of this approach is to avoid consequences when set interest rate too high or too low. When interest rate is set too high, it will rise financing cost which turns to dampen investments, leading to a weak economic growth. But when interest rate is set too low, it generates inflation and bubbles. However, given the challenge of calculating the real interest rates and potential growth rate, PBOC takes a conservative approach to set the real interest rate slightly below the potential growth rate.

There are various schools of thoughts on how monetary policy should be implemented including amplification strategy and attenuation strategy. The amplification strategy is a proactive way to implement monetary policy, requiring counter-cycle management, active intervention in the market and being financial accelerator. On the other side, the attenuation strategy is a more conservative approach. It proposes to act conservatively when uncertainties surrounding, leaving some leeway for future decisions.

When making interest rate decision, PBOC adapts a conservative policy or an attenuation strategy but also takes economic cycle and across region conditions into consideration. The focus is on the current state of Chinese economy, other factors such as the length of current cycle, the next stage of the cycle, the cycle average and the regional average are also considered. In terms of regions, PBOC examines economic conditions of United States, Europe, ASEAN and Japan. PBOC’s rate decision is cautiously shrinking towards cycle and regional average. This automatically recognizes the time lag of monetary policy and leaves spaces for future adjustments.

As above, the philosophy for PBOC to determine the interest rate is the ‘Golden Mean’,. It involves considering the current situation while looking into the past and future. It focuses on Chinese economy but takes other regions into account. By taking the mean (average) into consideration and shrinking estimates towards it, the interest rate decision is made with cautious.

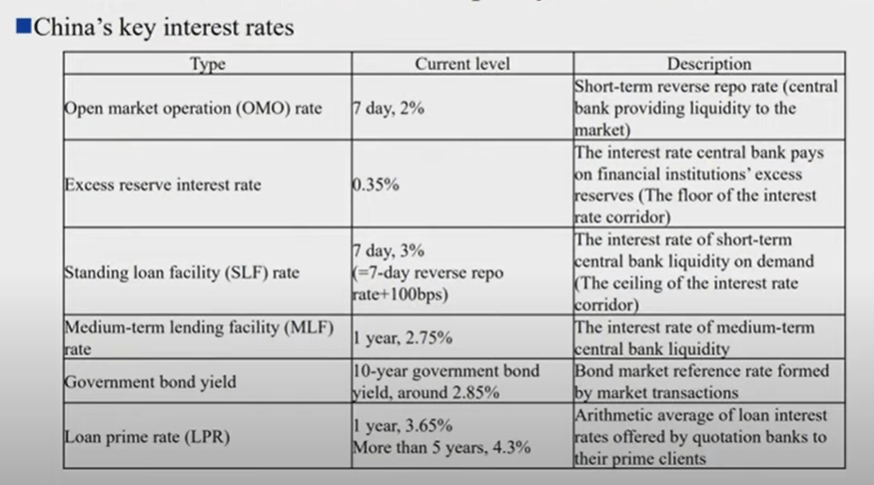

To understand China’s monetary policy, several key interest rates must be noted. PBOC started to try to use the mechanism of interest corridor (see PBOC Monetary Policy Department’s article ‘Further Promoting the Market-Oriented Interest Rate Reform (深入推进利率市场化改革)’ of 20 September 2022 ) . The lower bound is the excess reserve interest rate and the upper bound is the standing loan facility (SLF) rate. Market rate should be within the upper and lower bound, and 2% is PBOC’s target which is reflected int the OMO rate.

How PBOC implemented the ‘Golden Mean’ thoughts in real life example? Here are some cases.

Fed started a raise cycle from late 2015. From 2015 to 2018, PBOC’s one-year benchmark interest rate for one-year loan remained the same (the policy rate used by BIS) while US fed fund rate raised 225 bps. A tradition thought is that developing market central banks should follow what Fed does as a result of balance of payments and cross-board capital movement. However, PBOC only lifted 5bps in PBOC 7-day reverse repo rate at the beginning of 2018.

When Covid-19 broke globally in March 2020, Fed cut 150 bps shooting Fed Fund Rate to almost to zero. However, PBOC only cut 20 bps, which is showing in the chart below. The China interbank market 7-day repo rate had a huge drop around that time, but re-aligned with PBOC’s 7-day repo rate and were stablised throughout the pandemic period.

In 2022, when the US had a spike in inflation, Fed raised 425 bps to 4.375% at the year end. On the other side, considering China was still under a Covid-19 environment leading to a weak demand, PBOC actually cut rates for several times.

The above case indicates PBOC is not a follower of Fed in the past. Historical data from China displays that China’s real interest rate is below growth potential from 2000 to 2022, despite it had some large volatilities over the period. This is in line with PBOC’s goal of making real interest rate slightly lower than the potential growth rate.

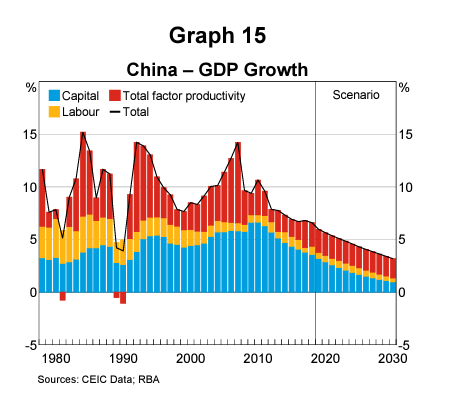

If PBOC continues the current strategy, it is reasonable to see that the real interest rate will be further declining in China. This is supported by GDP growth potential calculated separately by Bai and Zhang (2017) and Roberts and Russell (2019). In both research, China’s GDP growth rate will drop below 5% in later 2020s.

Reference:

Yi, G, ‘China’s Monetary Policy: Practice and Rationale’, speech at Peterson Institute for International Economics on 17 April 2023, accessed: Macro Week 2023: Yi Gang, Governor of the People’s Bank of China

Bai, C.-E., & Zhang, Q. (2017). A Research on China’s Economic Growth Potential (1st ed.). Routledge. https://doi.org/10.4324/9781315112343

Roberts, I., & Russell, B. (2019). Long-term Growth in China, Reserve Bank of Australia Bulletin December 2019, accessed: https://www.rba.gov.au/publications/bulletin/2019/dec/long-term-growth-in-china.html