Started from mid-2021, the inflation surge became a global issue in the post-Covid years. From March 2021, the US annual inflation rate jumped to a higher level and became persistent in the high level for relatively long period of time. The 12-month seasonally adjusted CPI percentage change is rising from 2.6% in March 2021 to 8.9% in June 2022 (data are sourced from U.S. Bureau of Labor Statistics), which is roughly the highest level in recent 10 years.

The cause of the inflation surge is still under debating. Economists were holding divisive views about the cause of inflation surge. Some believe supply chain disruption is the root cause. On the other hand, John Cochrane, who is a finance professor at Chicago Booth, is advocating ‘The Fiscal Theory of the Price Level’. He thinks the fiscal policy also plays a very important role in explaining inflation. He argues the price level adjusts so that the real value of government debt equals the present value of real primary surpluses, and the current inflation level might be a lasting effect of fiscal shock, such as an unexpected drop in surpluses.

However, three economists including Steve Hanke, Nicholas Hanlon and John Taylor have a strong view that the money supply is the key. They are against Chair Powell’s report to Congress that “the growth of M2 … doesn’t really have important implications for the economic outlook.”

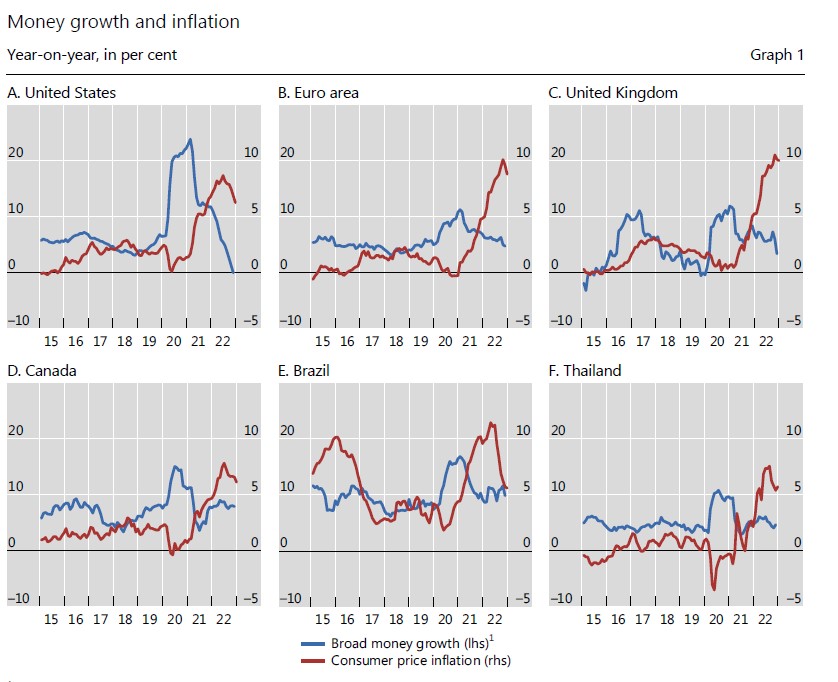

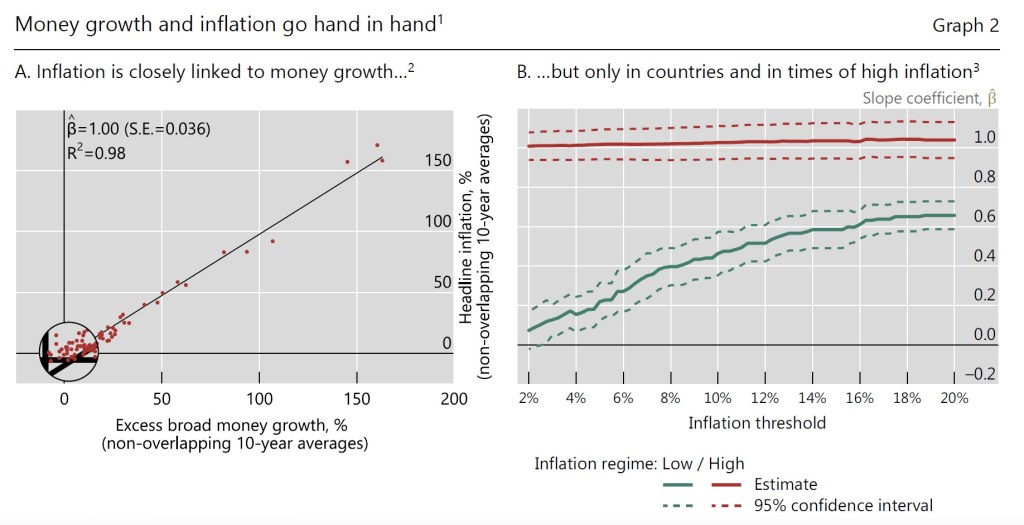

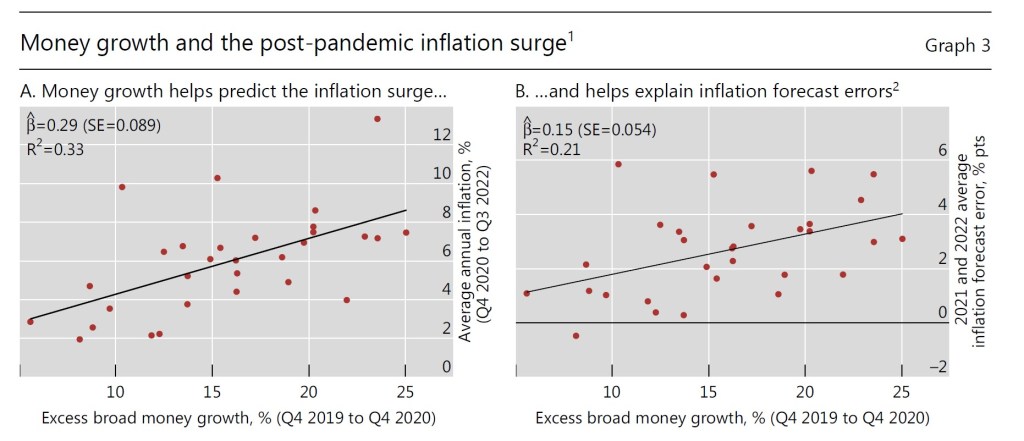

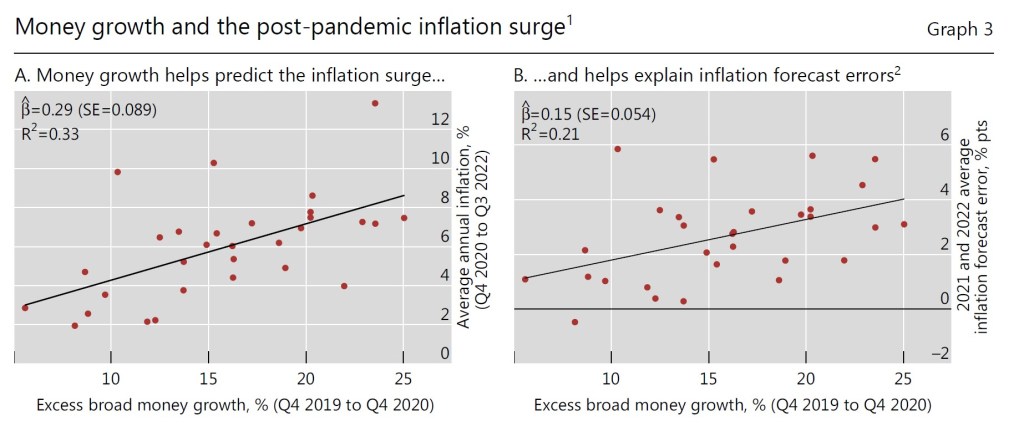

The recent BIS bulletin (Borio, Hofmann and Zakrajšek (2023)) provided some systematic evidence across different countries on the relationship between money supply and inflation. It somehow supports what the three economists’ view on money supply explaining inflation. Here are their findings from their short paper:

– There are two inflation regimes. In low-inflation regime, inflation reflects uncorrelated sector specific price changes while wages and prices are only loosely linked. In high-inflation regime, prices changes are more correlated across sectors, and wages and prices are more tightly linked.

– The link between money growth and inflation is strong when inflation is high and is weak when inflation is low.

– There is a clear linear relationship between excess money growth and headline inflation with data from 30 countries including both developed and developing countries. and the coefficient is more stable in high inflation environment.

– Taking excess money growth from 2020 into consideration reduces prediction error in inflation in 2021 and 2022.

Reference:

Austin, Craig (2021), Why are prices so high? Blame the supply chain – and that’s the reason inflation is here to stay, The Conversation, https://theconversation.com/why-are-prices-so-high-blame-the-supply-chain-and-thats-the-reason-inflation-is-here-to-stay-169441

Borio, Hofmann and Zakrajšek (2023), Does money growth help explain the recent inflation surge?, BIS Bulletin

Cochrane, John (2021), The Fiscal Theory of the Price Level: An Introduction and Overview (article), accessed https://www.johnhcochrane.com/s/Fiscal_theory_JEP.pdf

Cochrane, John (2022), The Fiscal Theory of Inflation (blog post), accessed https://johnhcochrane.blogspot.com/2022/08/the-fiscal-theory-of-inflation.html

Hanke, Steve H., Hanlon, Nicholas (2022), Jerome Powell is Wrong. Printing Money Causes Inflation, Commentary in Independent Institute, accessed https://www.independent.org/news/article.asp?id=14040