Fed issues a statement to public after each Federal Open Markets Committee (FOMC). The statement provides some brief information about the rationale behind the rate decision. The ex-Fed Chair Ben Bernanke started the commitment to provide more transparency on rate decision in April 2011 (ABC News, Arnall 2011), when he started to hold press conference after FOMC meetings associated with summary of economic projects (De Pooter 2021). But later, Chair Powell started to hold press conference after each FOMC.

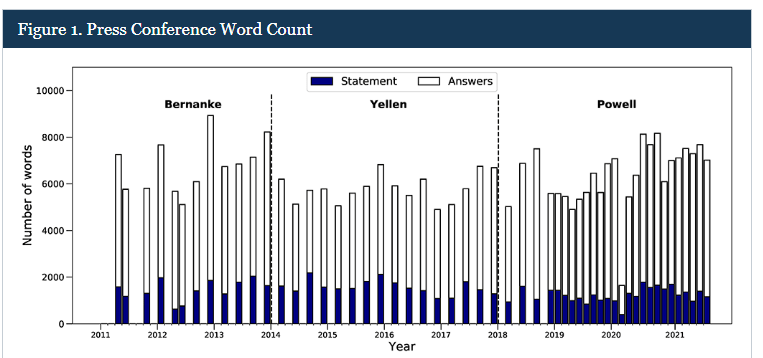

Until Feb 2023, three Fed Chairs have hold press conferences after FOMC. From De Pooter (2021), the number of words counted in press conference of the three Chairs of Bernank, Yellen and Powell make not much difference. But one interesting question to ask is whether the market reacts to different chairs’ press conference in the same way?

Narain and Sangani from Harvard University attempt to answer this question in their paper titled “The Market Impact of Fed Communications: The Role of the Press Conference” (Narain and Sangani 2023).

They examined the market response with intraday trading data around Chair’s press conferences after FOMC meetings between April 2011 and December 2022. They collected the releasing time of FOMC statements, the starting time of Chair’s press conference and the duration of each conference.

To measure market response, they collected data from both stock and bond markets. The measure stock market response is based the 5-min tick data of SPY and DIA. But for bond market, two types of data are collected – the intraday yield curve movements data by using Bloomberg USGG2YR index and the 30-day implied volatility on at-the-money Treasury option from Bloomberg calculation engine.

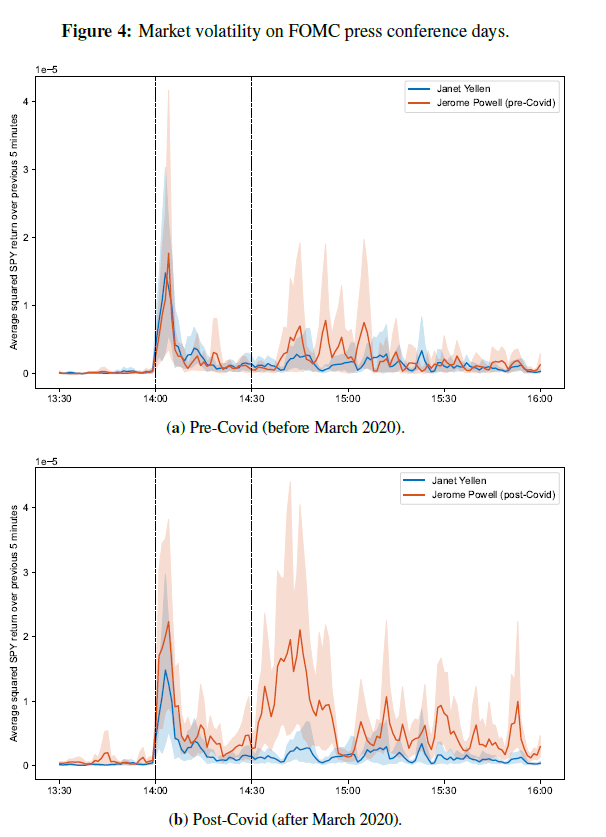

They measured the market volatility using squared return over 5-min interval on the SPY throughout the FOMC statement release and the Chair’s press conference post-FOMC.

Several interesting findings from their work:

- The market responds sharply to the release of FOMC statements, indicating a higher volatility after 2:00 PM. It might be due to market starts to incorporate the new information. There is a subsequent rise in volatility after the FOMC press conference if compared to the level before the release of FOMC statements.

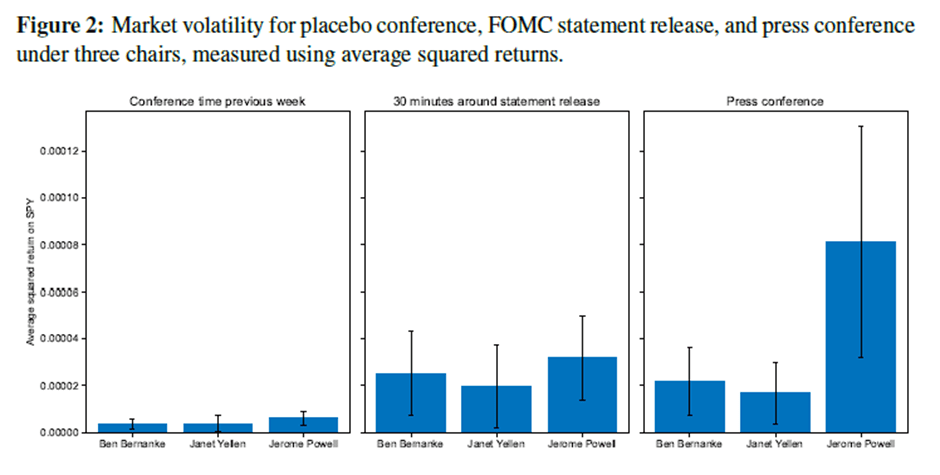

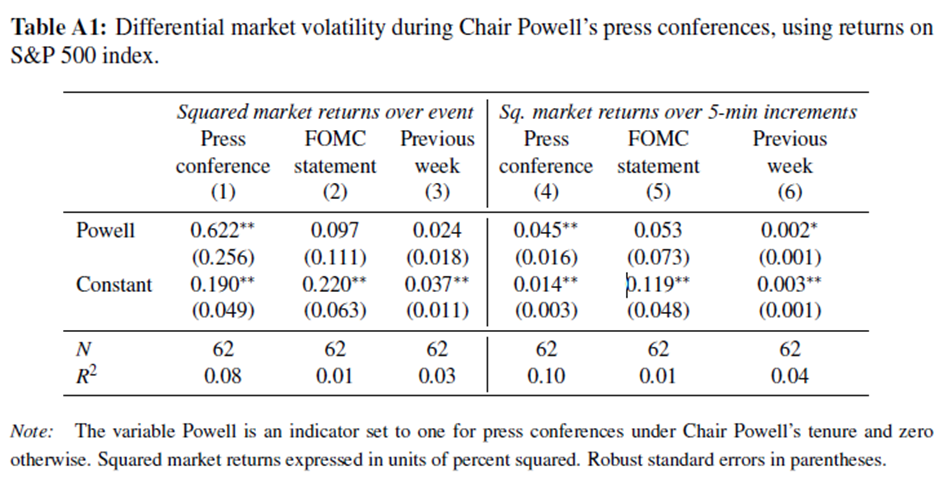

- By running comparisons in terms of market volatilities with placebo conferences, 30-min window after FOMC statement release and the duration of the press conferencing, the volatility under Chair Powell is on average higher than his predecessors. And they run a regression with a Chair Powell dummy variable confirming the higher volatility.

- They also used an alternative volatility measure to test. The measure is the squared return of SPY over 5-min increments during the press conferences. It shows the similar results that the market volatility is higher during the press conference under Chair Powell. They applied the same method to DIA, the results support that the volatility is higher on average during Chair Powell’s press conference.

- Measured by the relative market impact of press conference, which is defined by the two researchers as the volatility during the press conference over volatility after FOMC statement release. By using SPY data to measure, Chair Powell’s press conference has a higher relative market impact.

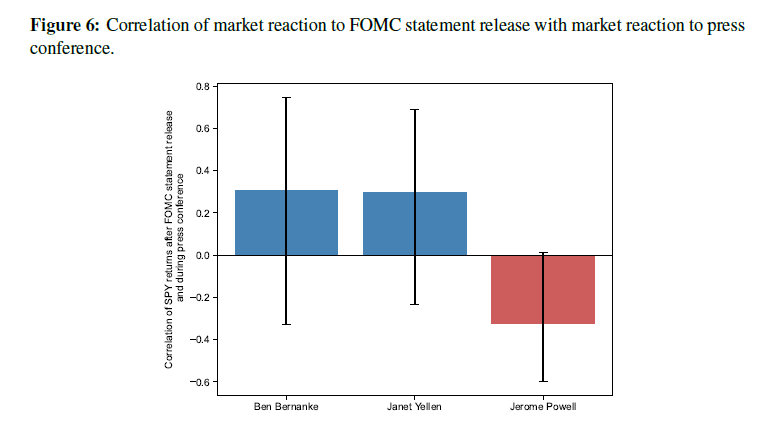

- Compared to the two previous chairs, the market return exhibits reversals under Chair Powell’s conference. It means that market returns tend to be in opposite directions following the FOMC statement and during Chair’s press conference.

- Dividing the data into pre- and post-Covid periods, they document that the market became much more volatile after the start of Chair Powell’s press conference.

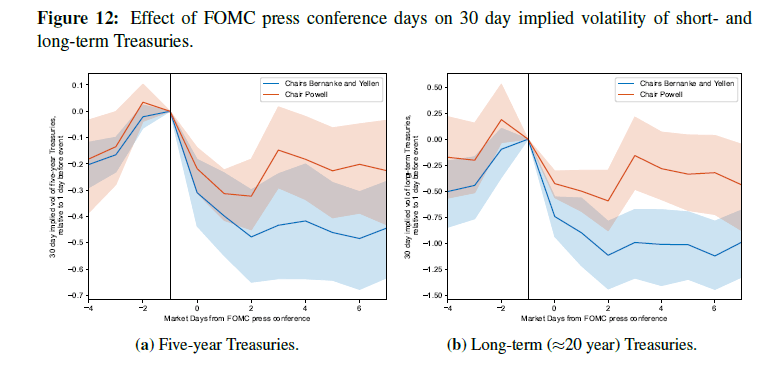

- On a forward-looking basis, both short- and long- term treasury’s implied volatilities tend to drop after a FOMC day. This is due to uncertainties are resolved on the FOMC day, however, the reduction in implied volatilities is slightly less under Chair Powell.

In addition to above results, they undertook some text analysis and case study on Chair Powell’s speeches and examined the market volatility for the press conferences associated with Economic Project Summary.

One interesting explanation they referred in their work is, “the realized market volatility can serve as an indicator for the release of market-relevant information.” (Rosa 2013 referred in Narain and Sangani 2023). So, Chair Powell’s press conference is a more important channel for affecting market expectation.

On a side note, their market volatility measure is the squared returns of SPY over 5-min periods. It is consistent with the realized volatility measure from Andersen, Bollerslev, Diebold and Labys (2001), where they show that the sum of squared interval returns can be used to approximate quadratic variation.

Information:

All above graphs are from Narain and Sangani (2023), except the first graph is from De Rotter (2021). The screenshot above is from taken from ABC website.

Kunal Sangani’s LinkedIn page is: https://www.linkedin.com/in/kunalsangani/

You can find their working paper via Kunal Sangani’s personal website: https://kunalsangani.com/

Reference:

Andersen, T., Bollerslev, T., Diebold, F., and Ebens, H. (2001), The Distribution of Realized Stock Return Volatility, Journal of Financial Economics, Vol.61, pp 43-76

Arnall, D. (2011), Bernanke Holds First Press Conference in Fed’s History, ABC News Report, https://abcnews.go.com/Politics/bernanke-holds-press-conference-feds-history/story?id=13470138, accessed 7 Feb 2023.

De Pooter, M. (2021), Questions and Answers: The Information Content of the Post-FOMC Meeting Press Conference, Fed Notes, https://www.federalreserve.gov/econres/notes/feds-notes/questions-and-answers-the-information-content-of-the-post-fomc-meeting-press-conference-20211012.html, accessed 7 Feb 2023.

Rosa, C. (2013), The Financial Market Effect of FOMC Minutes, Economic Policy Review, Vol. 19, No. 2, Available at SSRN: https://ssrn.com/abstract=2378398

Narain, N., and Sangani, K. (2023), The Market Impact of Fed Communications: The Role of the Press Conference, Working Paper.